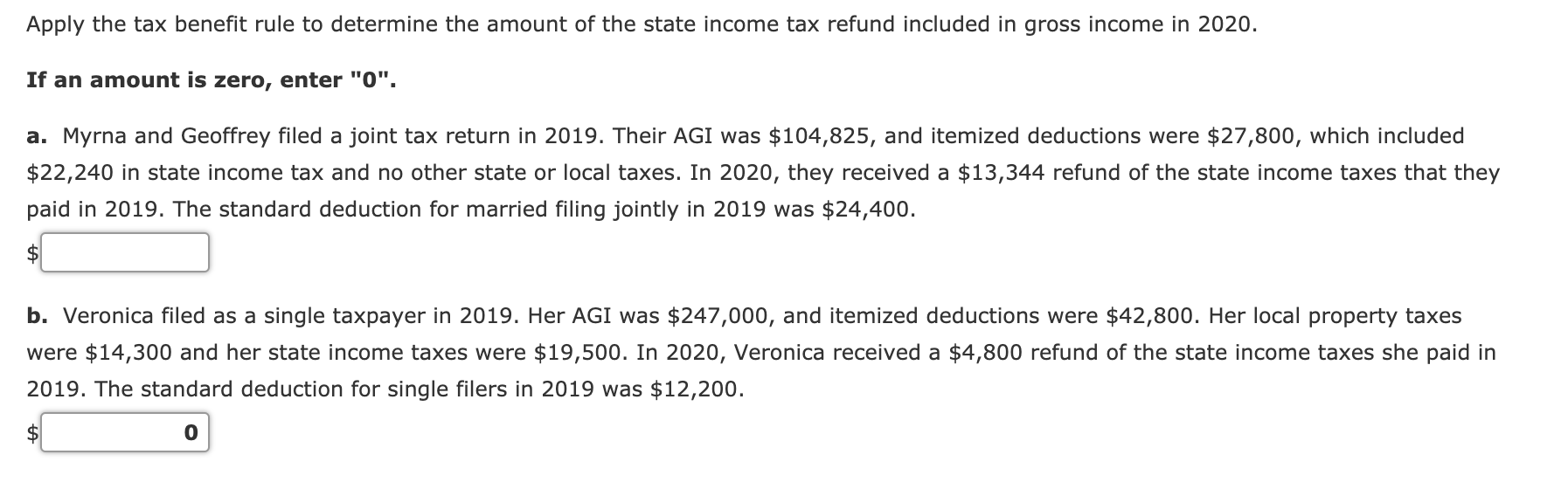

tax benefit rule calculation

For 2022 the monthly exclusion for qualified parking is 280 and the monthly. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the.

Tax Shield Formula How To Calculate Tax Shield With Example

Last drawn monthly salary as on date is taken into account.

. See Cents-Per-Mile Rule in section 3. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction taken for the refunded amount reduced tax in the earlier. If the couple received a state tax refund of 500 in the current year the taxpayer will.

Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. The OECD Tax-Benefit web calculator enables users to compare how tax liabilities and benefit entitlements affect the incomes of working-age families across countries and over time. If the total amount of your itemized deductions for 2012 was 7000 you must report as income the full 300 state tax refund on your 2013 return.

Year 1 interest paid year 1 property tax paid- if marked as deductible year 1 MI paid- if marked. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit. The tax benefit rule only applies if there is a tax benefit.

2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new. Tax benefits include tax credits tax deductions and tax deferrals. Your tax benefit is the difference between the 12600 deduction you would have claimed without the state tax.

The TAB is calculated by using a two-step procedure. Received no tax benefit from the overpayment of 750 in state income tax in 2018. Qualified parking exclusion and commuter transportation benefit.

Tax treatment of state and local tax refunds clarified. As per the provisions of the Income Tax Act the lowest of the below three amount shall be tax-free. More than 44000 up to 85 percent of your benefits may be taxable.

What is the Tax Benefit Rule. If the total amount of. Specifically for tax years 2018 through 2025 an individual may claim an itemized deduction on Schedule A of up to only 10000 5000 for married taxpayer filing a separate.

If using the cents-per-mile rule to value the benefit for the employee you multiply the number of miles the employee uses the vehicle for personal use by the IRS. 15000 2275 144750 de minimis threshold The calculation above that the de minimis threshold is 147750. A couple paid 4000 in state taxes in the prior year and claimed itemized deductions totaling 14000.

The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period. With the figure we can determine which form of tax. The tax benefit shown in the summary section is defined by the following equation.

This means that in the year the money was listed as a deduction the taxpayer wound up paying less tax as a. Thus B is not required to include the 750 state income tax refund in Bs gross income in 2019.

Know The Strategies When It Comes To Taxes On Options Ticker Tape

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Your 2020 Taxes Are Affected By The Coronavirus Pandemic The New York Times

Solved Apply The Tax Benefit Rule To Determine The Amount Of Chegg Com

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

How To Deduct Stock Losses From Your Taxes Bankrate

Selling Stock How Capital Gains Are Taxed The Motley Fool

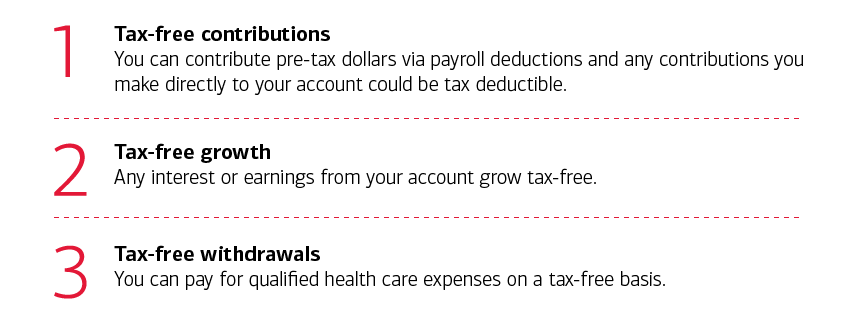

Realize The Potential Of Hsa Tax Benefits

What Is The Tax Benefit Rule Thestreet

California Tax Expenditure Proposals Income Tax Introduction

Taxes On Social Security Benefits Kiplinger

A Smart Artist S Guide To Income Taxes The Creative Independent

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

Section 179 Tax Deduction For 2022 Section179 Org

Tax Benefit Rule Income Tax Course Cpa Exam Regulation Youtube

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center